Content

As mentioned in the introduction, Scandinavian Capital Markets operates exclusively as a gateway to top tier venues and liquidity providers. The various execution models discussed in this article are intended to present a contrast between what we do and what others do. Brokers often aggregate liquidity from multiple sources to access the best types of brokers possible pricing and get more weight behind those prices. There are numerous high-calibre forex price aggregation, and distribution platforms relied on by brokers worldwide. However, due to the fragmentation of the wholesale liquidity sector, aggregation is tricky. Many brokers believe when adding LPs into their network, the more the merrier.

A forex broker is a company that serves as a liaison for the execution of forex trading transactions of buyers and sellers in order to earn commission, once the deal is final. Secondly, you need to check the trading costs of a forex broker as this factor is perhaps the most crucial one. Obviously, it would be much easier to start trading forex pairs with a discount broker and not lose money on paying high trading fees.

Forex brokers provide an essential service in enabling customers to trade on what is a decentralised market. Like most businesses in the service industry, they make their money by charging customers to use the service. The content on this website is subject to change at any time without notice, and is provided for the sole purpose of assisting traders to make independent investment decisions.

Spreads directly from our liquidity providers + direct access to the interbank market. You will receive the standard ECN account automatically once you have opened a real account with us. The final check is the MiFID II regulation, according to which investment firms in the European Union must disclose information on the execution of client orders – under theRTS28 report. A simple check shows that last year, Purple Trading used four different liquidity providers. B-Book brokers still use a live price feed, usually obtained from a prime broker or an aggregated average price feed obtained from multiple sources, taking prices from several banks, exchanges and market makers. In the OTC FX and CFD trading industry, there are many thousands of brokers catering to a variety of different customer profiles.

Straight Through Processing (STP) Brokers

Because individual investors cannot buy shares directly from the stock market, you would need a stock broker. A broker is an independent person or a company that organises and executes financial transactions on behalf of another party. They can do this across a number https://xcritical.com/ of different asset classes, including stocks, forex, real estate and insurance. A broker will normally charge a commission for the order to be executed. It’s how individuals, businesses, central banks and governments pay for goods and services in other economies.

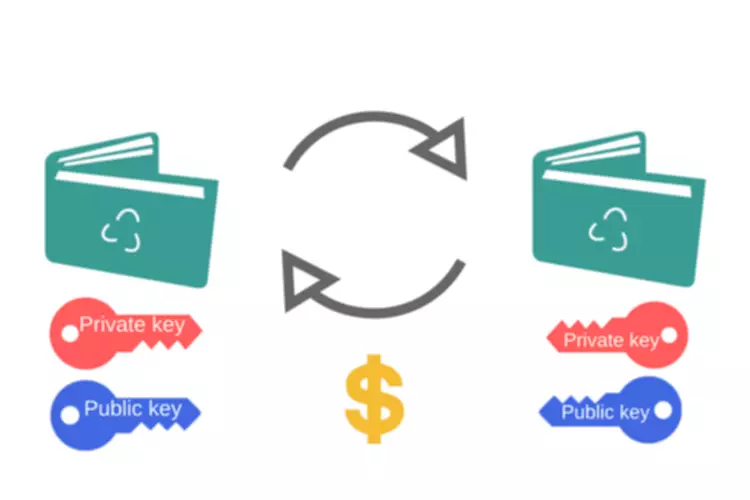

The trader submits an order to a broker, and then the broker submits it to their liquidity provider. At Scandinavian Capital Markets, we exclusively act as a broker who negotiates terms and connects clients with various liquidity sources, depending on their needs. There is not much ambiguity around that practice, but if you want to understand what we do behind the scenes, read our recent article on how we build the best forex liquidity feeds. In this article, we look at other models forex brokers use to execute trades and to provide liquidity. They will typically offer very competitive spreads since they are getting pricing directly from the interbank market.

One type of non-MM broker is the ECN, standing for Electronic Communications Network. ECN brokers usually charge a commission, although the popularity of spread pricing makes that a less than rock-hard rule. Many ECN’s send transactions through their network to be executed by the market-maker’s dealing desk in a process named “straight through processing,” or STP. The more market-makers the ECN has in its stable, the better for the customer because it implies that a wide range of bid-offer spreads will be available at all times. The ECN generally pays the market makers a “rebate” based on the order flow it can provide, meaning the higher the ECN’s customer base, the lower the commission or spread. Alternatively, some ECN’s match retail buyers and sellers first before sending a net order through to the banks or other liquidity providers.

Forex brokers try to minimise their costs to stay competitive in the market, but you still pay certain fees when trading with them, including a spread. Transactions in the forex market are done in pairs, so you’d either buy or sell the pair you’d want to trade – for example GBP/USD. In the early days of the retail forex trading industry, A-Book brokers were far more common than they are today. The A-Book business model became more expensive and less competitive. Straight-Through Processing brokerage firms are also known as Direct Market Access brokers. These brokers give their traders direct access to the interbank FX market, where pricing and execution is done by the big banks acting as the liquidity providers.

What are the different types of Forex brokers

Tradersunion.com needs to review the security of your connection before proceeding. First, let’s break down how each of these two different types of brokers are set up. We use the information you provide to contact you about your membership with us and to provide you with relevant content.

IG International Limited receives services from other members of the IG Group including IG Markets Limited. Unlike most MetaTrader 4 platforms, you’ll have free access to integrated Reuters news. Check out our handy platform comparison table which will show you all the differences. Save up to 15% with cash rebates as high as $10 per million traded. Additionally, have interest paid up to 5% on your average daily available margin balance. Access additional exposure into unleveraged spot metals and diversify your trading.

What is a stock broker?

Once MetaTrader is downloaded, the trader can open a demo account with the broker of their choice, or they can open multiple demo accounts with more than one broker. The account types that fall into this category often require a substantial initial investment and are offered to people who do not wish to deal with the hassle of trading or trade decision making. Do not be deceived by smart marketing when analyzing the different types of brokers. Focus on the factors that matter to ensure the safety of your trading capital and any profits you have made. Ensure you are comfortable with the spreads and swaps charged by any broker, regardless of their classification.

For that matter, there are different types of forex brokers that can be divided into dealing desk and no dealing desk forex brokers and each one has its own pros and cons. Live Forex Trading Account – A live forex trading account can typically be funded with anywhere from $50 to whatever limit the online forex brokerage has placed on client deposits. Once the live account is opened and funded with real money, the trader can then initiate and liquidate trades in the forex market. Depending on the type of account chosen and its capitalization, the trader might be able to trade currency pairs in full lots, mini lots or micro lots. Also, forex brokers offer investors to trade currency pairs with significant leverage ratio, which is essentially the use of trading currency pairs with borrowed funds from your forex broker.

Day Trading in the UK: How to Get Started

Join the Active Trader program to enjoy waived bank fees for your wire transfers. The spoils of being a valued client don’t end there, as you also get access to exclusive events and product previews. Access TradingView charts with over 80 indicators, Reuters news feeds, behavioral science technology and much more with our web trading platform. Intuitive and packed with tools and features, trade on the go with one-swipe trading, TradingView charts and exclusive tools like Performance Analytics and SMART Signals. Refine your trading with exclusive data tools like Performance Analyticsand SMART Signals.

- Micro Account – The micro account usually lets traders open the account with a minimal initial deposit like $50 to $100.

- A hybrid STP or ECN offers micro lots but could be trading against you.

- Market makers are always the counter-party of the trader, who doesn’t trade directly with the liquidity providers.

- Consider a broker who has two LPs and has deployed capital with each provider.

- These No Dealing Desk STP forex brokers usually work with a variety of liquidity providers, with each provider quoting their own bid and ask prices and executing their clients’ forex trades.

- ECN brokers usually charge a commission, although the popularity of spread pricing makes that a less than rock-hard rule.

You should still always check out an STP broker’s risk management policy to learn about their exact practices. While this might sounds like the simplest solution for a Forex trader , it does require a much higher investment capital as most parties in the interbank market only trade very large lots. Therefore, ECN brokers can require minimum account sizes in the ranges of $1K – $50K.

How to Open a Forex Trading Account with Online Brokerage Firms

API Access for Automated Trading – an API or Application Programming Interface enables a software program to initiate and liquidate forex trades automatically when certain pre-specified market conditions are achieved. B2Broker offers a variety of forex software solutions for launching and improving brokerage applications. Forex Demo Account – A forex demo account allows the trader to test their trading plan for profitability, drawdowns and other performance measures.

Let’s open an account and trade with us!

Some brokers will provide you with market data and give you advice on the products you want to buy or sell – depending on whether they are a full service broker, or execution only. However, a broker must be licensed to give advice and execute the sale, and they will only perform trades on your behalf once you have given them the go-ahead. Powerful platforms, tight spreads, fast execution, and dedicated support. See why we’re the trading partner of choice for hundreds of thousands of traders worldwide. Forex brokers come in many forms, from reputable brokerage companies to criminal operators.

Forex traders, whether novices or professionals, should select their brokers carefully to guarantee they deal with a trusted company. Note that although most of these dealers generally have the same foreign exchange access and quality, their processes and rules nevertheless vary significantly. Testing the broker’s fund withdrawal policy can also make sense to make sure that funds are returned promptly upon request. Micro Account – The micro account usually lets traders open the account with a minimal initial deposit like $50 to $100. In addition, the minimum trade size is usually one micro lot or 1,000 units of the base currency. Non-Dealing Desk brokers decide what bids and offers to show from among their liquidity providers, reducing confusion.

This process is named “aggregation” and is sold as a way to improve liquidity over an ECN that may have only one or a small number of price providers, including other retail traders. When you are trading on an NDD platform, you see one price feed at the choosing of the broker and you do not know the name of the counterparty — it could be a bank, brokerage, mutual fund, or another broker. The benefit of that the counterparty does not see your stops or other components of your overall trade, and so cannot manipulate prices to scam you. The liquidity provider sees only the one trade component and you are anonymous to him.

The spread, as described above, is the difference between the buy and sell price. The thing about Forex brokers is that some of them can provide a great spread and great trading conditions that can help you win. If you choose one with a high spread, then your trades can easily take away a lot of your profit margin. Most of the time, it’s what discourages people from entering into forex in the first place. However, there’s really nothing to be afraid of as long as you know what you need to consider when looking for a forex broker. While there is indeed a lot to consider, having a comprehensive list can really help you a lot when deciding which broker to choose.

You should find a broker that offers the currency you can use for your transactions. 69.50 % of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money. CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage.69.50% of retail investors lose their capital when trading CFDs with this provider.